by Jonathan Foxx

Jonathan Foxx, former Chief Compliance Officer of two publicly traded financial institutions, is the President and Managing Director of Lenders Compliance Group, the first full-service, mortgage risk management firm in the country.

As published in the August 2010 Edition of National Mortgage Professional Magazine.

____________________________________

WHO’S IN CHARGE HERE?

I never blame myself when I'm not hitting. I just blame the bat and if it keeps up, I change bats. After all, if I know it isn't my fault that I'm not hitting, how can I get mad at myself?

Yogi Berra

Let’s admit it: the tendency to pretend we’re holding somebody or some entity “accountable” for the mortgage crisis, when we’re really not, is just a fashionable avoidance of that unpleasant word: “blame.” Once that label sticks, it’s on to dealing with the nasty culprits!

Blaming is purported to be cowardly, even passive; and being held accountable is lauded as proactive and high-minded. So, the word “accountable” is now in vogue, instead of “blame.” Frankly, the word “accountable” in today’s world is merely politically-correct, euphemistic Newspeak for the fact that “you know you did wrong, I know you did wrong, everybody in the world knows you did wrong, but you’ll pay no penalties whatsoever for doing anything wrong.”

Although the tone-at-the-top mantra of the Obama Administration is “let’s look forward and not look back,” or the Bush Administration’s tactic of retroactively making lawful what was heretofore unlawful (or unconstitutional) remains beyond contest, or the on-going trading of opaque financial instruments seems to continue in an entirely unregulated market, or many government departments and agencies are still remaining reactive at best during a crisis – in the Newspeak of our times, we are assured of accountability, which now apparently means there’s nobody to blame at all, nobody held responsible for the meltdown, nobody to put in jail. Everybody’s free to go and, we’re admonished, it doesn’t do any good to blame anybody for anything, since we can’t fix this mortgage mess unless and until we all can get along, be bi-partisan, be post-partisan, and look to the better angels of our nature!

Accountability these days seems to mean no adverse consequences to the perpetrator and no blame for anybody. If you find a person to blame, that person’s not accountable; and if you find somebody who is accountable, that person is not to blame. While lobbyists, dogmatists, political catechists, and ideologues just make stuff up, they’ve found the culprit for sure, those bad actors portrayed as directly and indirectly culpable, the rapacious mortgage originators: they certainly should be blamed, reined in, re-regulated, and de-incentivized for having largely contributed to the worst financial crisis since the Great Depression!

Portraying mortgage originators as the culprit is a politically useful narrative meant for the consumption of low information voters; but, as we’ll see, there is plenty of blame in this game and, to date, not much real, old-fashioned accountability – the kind that has real world consequences – except, of course, for those who originated the mortgages in the first place.

Results are what you expect,

consequences are what you get.

Anonymous

On Tuesday, June 22, 2010, a Conference Committee met in Room 106 of the Dirksen Senate Office Building, in Washington, to reconcile Senate and House versions of H.R. 4173, known as the Wall Street Reform and Consumer Protection Act. That bill ostensibly was drafted to create a new consumer financial protection “watchdog,” bring about an end to “too big to fail” bailouts, set up an early warning system to “predict and prevent” the next crisis, and bring transparency and accountability to exotic instruments such as derivatives. Led by Representative Barnie Frank (D-MA) and Senator Christopher Dodd (D-CT), the conferees reviewed and voted on new regulations as well as additions, deletions, and revisions of existing regulations.

The list of new regulations and amendments to existing regulations, consisting of thousands of pages, read like the attenuated, convoluted, cross-tabulated Index Section of a Whodunit’s Guide to the Perplexed. Seated around a large, rectangular dais, the Committee’s politicians called one another out, speechified, postured, and legislated to protect their respective constituencies, absolved themselves of ever having allowed their own politics to contribute to the financial crisis, while the Clerk recorded votes, staff members raced around, and lawyers scurried about with various and sundry red-lined versions of financial reform legislation.

On Friday, June 25, 2010, all the backroom, sub rosa, deals were ironed out, all the special interests had their way or lost their sway, and the votes tallied up mostly across party lines: Democrats – Aye; Republicans – Nay. The Ayes had it!

Congratulations filled the conference chamber, Representatives and Senators praised one another, staff high-fived and hugged one another, and President Obama hailed the legislation as the “toughest financial reforms since the ones we passed in the aftermath of the Great Depression." Now only House and Senate approval was needed, and thence the President’s multi-pen signature, to become the law – which it did on July 21, 2010, just before noon. The legislation, now known as the Dodd-Frank Act, became the law of the land.

Among the many features of the legislation, the following was gaveled in:

- Requiring Lenders to Ensure a Borrower's Ability to Repay: Establishing a “simple federal standard” (sic) for all home loans to ensure that borrowers can repay the loans they are sold.

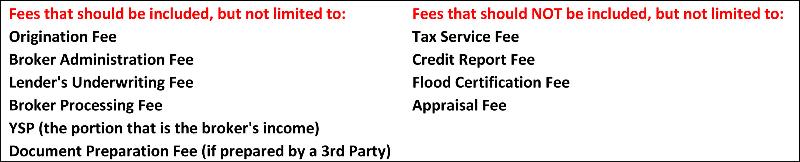

- Prohibiting Unfair Lending Practices: Prohibiting the financial incentives for subprime loans that “encourage lenders to steer borrowers into more costly loans,” including the bonuses known as yield spread premiums that “lenders pay to brokers to inflate the cost of loans.”

- Penalizing Irresponsible Lending: Issuing monetary penalties to lenders and mortgage brokers who don’t comply with new standards by holding them accountable for as high as three-year’s interest payments and damages plus attorney’s fees (if any), and, protects borrowers against foreclosure for violations of the new standards.

- Expanding Consumer Protections for High-Cost Mortgages: Expanding the protections available under federal rules on high-cost loans -- lowering the interest rate and the points and fee triggers that define high cost loans.

- Mandating Additional Mortgage Disclosures: Requiring lenders to disclose the maximum a consumer could pay on a variable rate mortgage, with a warning that payments will vary based on interest rate changes.

- Establishing an Office of Housing Counseling: Establishing a special office within the Department of Housing and Urban Development (HUD) to “boost homeownership and rental housing” counseling.

___________________________________________

Lenders Compliance Group is the first full-service, mortgage risk management firm in the country, specializing exclusively in mortgage compliance and offering a full suite of hands-on and automated services in residential mortgage banking.