On March 18, 2011, the Department of Housing and Urban Development (HUD) issued its RESPA Roundup, this issue being devoted to completing the Good Faith Estimate (GFE) in order to disclose loan originator compensation pursuant to the new TILA Loan Originator Compensation rule (Rule). [75 F.R. 58509 (September 24, 2010)]

HUD's guidance addresses the following issues:

(1) Mortgage broker transactions where the broker is compensated indirectly from the lender by means other than an amount that is computed based on the interest rate, such as by a flat fee or an amount that is based on any other computation;

(2) No cost transactions where the credit for the interest rate chosen covers third party settlement charges;

(3) Using a credit/charge calculation prior to completing Block 2 on the GFE; and

(4) Payments by lenders to borrowers to correct tolerance violations in wholesale transactions.

I will simplify the technical aspects of this HUD issuance, in order to clarify how to complete the GFE.

(1) Mortgage Broker Transactions

(Flat Fee Compensation)

Block 2 instructions state: "[f]or a mortgage broker, the credit or charge for the specific interest rate chosen is the net payment to the mortgage broker from the lender (i.e., the sum of all payments to the mortgage broker from the lender, including payments based on the loan amount, a flat rate, or any other computation, and in a table funded transaction, the loan amount less the price paid for the loan by the lender)."

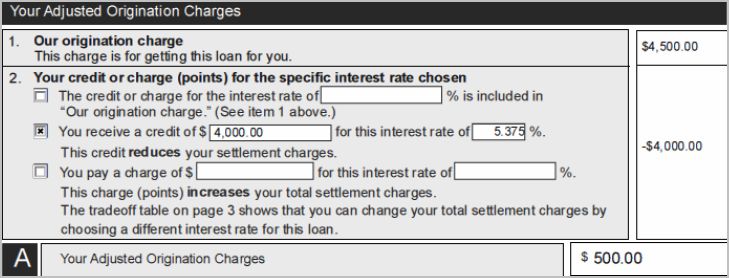

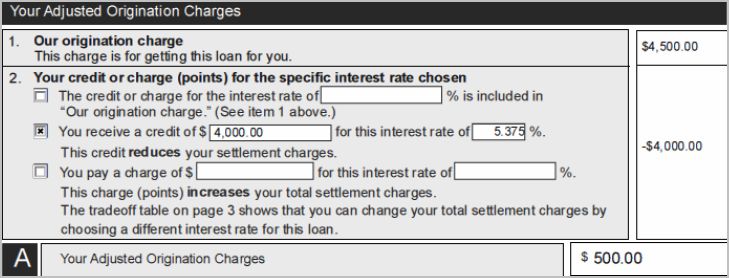

Illustration: Flat Fee Compensation

Example:

a) Flat Fee to Mortgage Broker is $4,000 (to be paid by the lender).

b) The lender charges $500 for processing and administrative fees.

GFE: Block 1 reflects a charge of $4,500. (Block 2 has a credit of $4,000, adjusted origination charge of $500 in Block A.)

(2) No Cost Transactions

(Interest Rate Covers Originator

or Third Party Settlement Charges)

Overview:

Only Originator Fees: Line A would show a zero (0) charge as the adjusted origination charge.

Originator Fees and Third Party Charges: All third party fees must still be itemized and listed in Block 3 through Block 11 on the GFE.

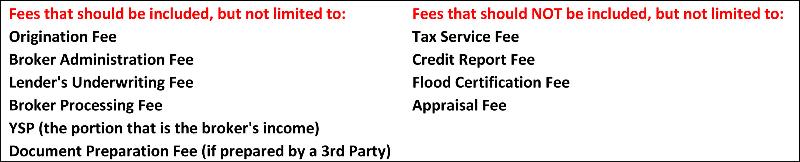

NOTE (1): Block 1 includes lender and mortgage broker compensation as well as all other charges that the lender and mortgage broker will receive. Thus, Block 1 provides total compensation to lender and mortgage broker.

NOTE (2): Block 2 is used for the credit or charge for the interest rate chosen.

(A) If "no cost" refers to only the lender and mortgage broker's fees, Block 2 offsets Block 1 resulting in $0 on Line A.

(B) If "no cost" refers to both Block 1 and the third party settlement charges (itemized in Blocks 3-11), the credit in Block 2 covers Block 1 and Blocks 3 through 11, resulting in $0 for the sum of Lines A and B.

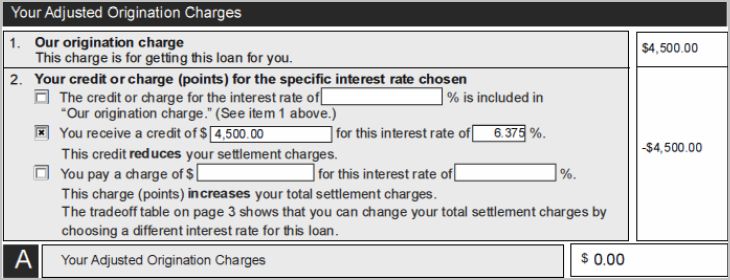

Example

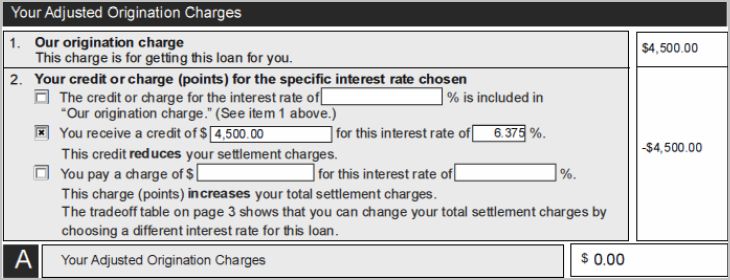

No cost loan covering only lender and mortgage broker charges (i.e., not third party settlement charges).

In the following GFE, the total compensation for the lender and mortgage broker is $4,500, as reflected in Block 1. Borrower is locked in an interest rate of 6.375% such that the credit for the interest rate chosen results in a credit of $4,500. Thus, Block A results in $0.

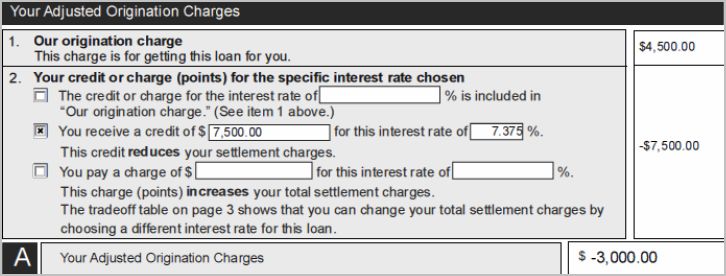

Example

Example

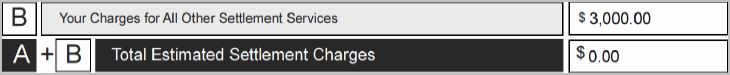

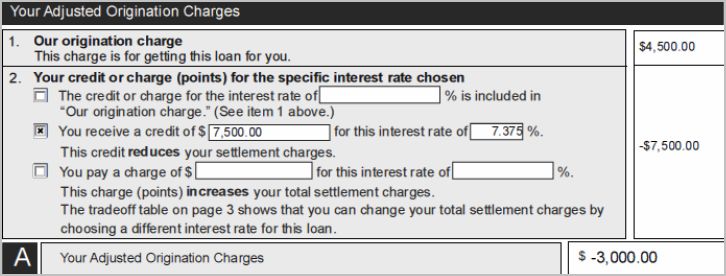

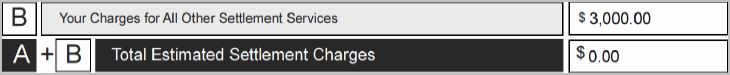

No cost loan covering lender, mortgage broker and third party settlement charges.

In the following GFE, the total compensation for both the lender and mortgage broker is $4,500, as reflected in Block 1. The borrower has locked in an interest rate of 7.375% such that the credit for the interest rate chosen results in a credit of $7,500. Block A results in a credit of $3,000 to offset the total of all third party charges in Block 3 through Block 11.

(3) Using a Charge or Credit Calculation

Prior to Completing Block 2 of the GFE

Overview:

RESPA provides: "[w]hen the net payment to the mortgage broker from the lender is positive, there is a credit to the borrower and it is entered as a negative amount in Block 2 of the GFE. When the net payment to the mortgage broker from the lender is negative, there is a charge to the borrower and it is entered as a positive amount in Block 2 of the GFE."

NOTE: the Rule prohibits a loan originator (as defined by the FRB) from receiving compensation directly from the consumer when it has received compensation from any person other than the consumer in connection with the transaction.

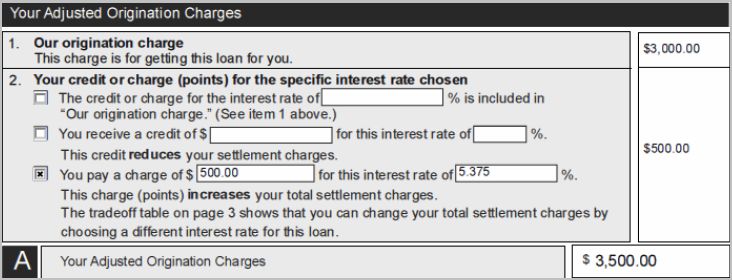

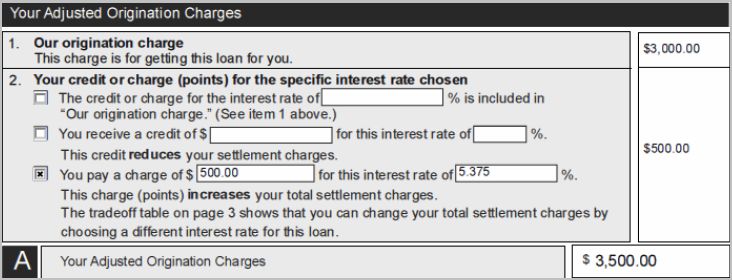

Example: Charge in Block 2

a) Principal balance is $250,000.

b) Lender charges $1,000 for processing and administrative fees.

c) Broker's compensation is $2,000, fully paid by the lender.

In the following GFE, the total origination charge in Block 1 is $3,000. The interest rate chosen a $2,000 credit. Pricing adjustments result in a $2,500 charge. The resulting $500 charge is placed in Block 2 and box three would be checked. The sum of Block 1 and Block 2 results in an adjusted origination charge in Line A of $3,500.

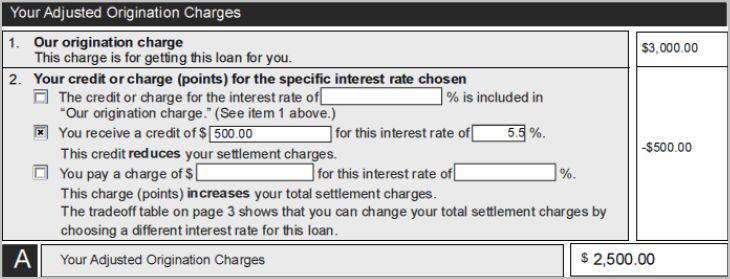

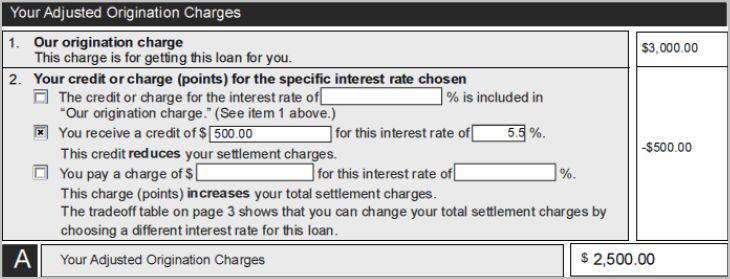

Example: Credit in Block 2

Example: Credit in Block 2

a) Principal balance of $250,000.

b) Lender charges $1,000 for an origination fee.

c) Broker receives $2,000 in indirect compensation from the lender.

In the following GFE, the total origination charge in Block 1 is $3,000. The interest rate chosen has a $2,000 credit. Pricing adjustments result in a $1,500 charge. The resulting $500 credit is placed in Block 2 and box two would be checked. The sum of Block 1 and Block 2 results in an adjusted origination charge in Line A of $2,500.

(4) Payments by Lenders to Borrowers for

Tolerance Violations in Wholesale Transactions

HUD restates the RESPA statute by emphasizing that regulations impose tolerance levels on charges disclosed on the GFE. Where actual charges to the borrower exceed these thresholds, mortgage brokers and lenders may cure to avoid a tolerance violation.

Advice given by HUD: timely and effective communication among the lender, its loan officers, and mortgage brokers to establish policies and procedures to ensure accurate calculation of compensation and credits in compliance with RESPA, as well as under the FRB compensation rule and any other applicable federal or state statute.

In other words, in HUD's view tolerance violations remain the burden to cure, though HUD provides no further guidance.

Some Observations

Changed Circumstances: The FRB's compensation rule will go into effect on April 1, 2011 and absent other factors cannot be considered a basis for a changed circumstance to revise the GFE pursuant to 24 C.F.R. §3500.7(f).

Volume Based Compensation: If a lender is basing its compensation to mortgage brokers on loan volume, as described in the new FRB compensation rule, it is nevertheless necessary to comply with RESPA Section 8 (12 U.S.C. 2607), which prohibits the payment of things of value or kickbacks in exchange for the referral of business to settlement service providers, including creditors.

Company Name Disclosed in Section F of the HUD-1: The name of the company originating the loan should be placed in Section F of the HUD-1. The name of any individual loan officer or mortgage broker is not disclosed.

Visit Library

Compliance Guidance for RESPA's Good Faith Estimate:

FRB's MLO Compensation Rules

HUD - RESPA Roundup,

March 18, 2011