by Jonathan Foxx

Jonathan Foxx, former Chief Compliance Officer of two publicly traded financial institutions, is the President and Managing Director of Lenders Compliance Group.

As published in the January 2010 Edition of National Mortgage Professional Magazine.

[>> Printable Version]

In 2008, the Department of Housing and Urban Development (HUD) issued both technical and substantive amendments to the rule that implements RESPA.[i] The technical changes took effect on January 16, 2009 and substantive changes have taken effect on January 1, 2010.

Recently, I provided a brief analysis of the new Good Faith Estimate (GFE).[ii] In this article I will offer some procedural guidance that incorporates several substantive changes that took effect on January 1, 2010. This analysis is meant as an overview of those changes.[iii]

Notably, the federal regulatory agencies will now begin examining for compliance with the new substantive provisions of the new RESPA Reform Rule on January 1, 2010.[iv]

Among other things, substantial changes have been made to:

- Good Faith Estimate (GFE)

- HUD-1 Settlement Statement (HUD-1)

- HUD-1A Settlement Statement (HUD-1A)

- Settlement Cost Booklet[v]

To facilitate the understanding of this article and the new RESPA Reform Rule, visit HUD’s RESPA section.

My firm’s website Library contains all of the documents listed above, the Final Rule, all New RESPA FAQs updates, as well as RESPA Appendices A and C, respectively, Instructions for completing the HUD-1/1A, and Instructions for completing the Good Faith Estimate, and the revised Settlement Cost Booklet.

I will consider the five following RESPA revisions:[vi]

- New Good Faith Estimate Form

- Binding Good Faith Estimate

- Tolerances on Settlement Costs

- HUD-1/1A Settlement Statement

- Settlement Cost Booklet

New Good Faith Estimate form[vii]

As of January 1, 2010, lenders and mortgage brokers[viii] must provide a standard Good Faith Estimate (GFE) form to a borrower within three business days[ix] of receipt of an application for a mortgage loan. The new GFE compares settlement costs and loan terms from various loan originators. Areas covered by the GFE include:

- a summary of loan terms and a summary of estimated settlement charges

- key dates (i.e., expiration dates of the interest rate and settlement charges)

- settlement charges disclosed as subtotals for eleven (11) cost categories

- a table explaining which charges can change at settlement

- a trade-off table showing the relationship between the interest rate and the settlement charges

- a chart for comparing the costs and terms of loans offered by different originators

First Page of GFE

The first page of the GFE discloses identifying information such as the name and address of the “loan originator” which includes the lender or the mortgage broker originating the loan. The “purpose” section indicates what the GFE is about and directs the borrower to the Truth in Lending disclosures and HUD’s Website for more information. The borrower is informed that only the borrower can shop for the best loan and that the borrower should compare loan offers using the shopping chart on the third page of the GFE.

The “important dates” section requires the loan originator to state the expiration date for the interest rate for the loan provided in the GFE as well as the expiration date for the estimate of other settlement charges and the loan terms not dependent upon the interest rate.

While the interest rate stated on the GFE is not required to be honored for any specific period of time, the estimate for the other settlement charges and other loan terms must be honored for at least ten (10) business days from when the GFE is provided.

- The form must state how many calendar days within which the borrower must go to settlement once the interest rate is locked (i.e., rate lock period). The form also requires disclosure of how many days prior to settlement the interest rate would have to be locked, if applicable.

- The “summary of your loan” section requires disclosure of the loan amount; loan term; initial interest rate; initial monthly payment for principal, interest, and any mortgage insurance; whether the interest rate can rise, and if so, the maximum rate to which it can rise over the life of the loan, and the period of time after which the interest rate can first change; whether the loan balance can rise if the payments are made on time, and if so, the maximum amount to which it can rise over the life of the loan; whether the monthly amount owed for principal, interest, and any mortgage insurance can rise even if payments are made on time, and if so, the maximum amount to which the monthly amount owed can ever rise over the life of the loan; whether the loan has a prepayment penalty, and if so, the maximum amount it could be; and, whether the loan has a balloon payment, and if so, the amount of such payment and in how many years it will be due.

- The “escrow account information” section requires the loan originator to indicate whether the loan does or does not have an escrow account to pay property taxes or other property related charges. In addition, this section also requires the disclosure of the monthly amount owed for principal, interest, and any mortgage insurance.

- The bottom of the first page includes subtotals for the adjusted origination charges and charges for all other settlement charges listed on page two, along with the total estimated settlement charges.

Second Page of GFE

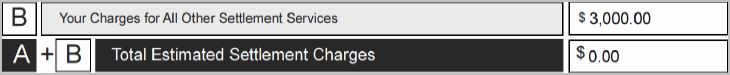

The second page of the GFE requires disclosure of all settlement charges. It provides for the estimate of total settlement costs in eleven categories discussed below. The adjusted origination charges are disclosed in “Block A” and all other settlement charges are disclosed in “Block B.” The amounts in the blocks are to be added to arrive at the “total estimated settlement charges” which is required to be listed at the bottom of the page.

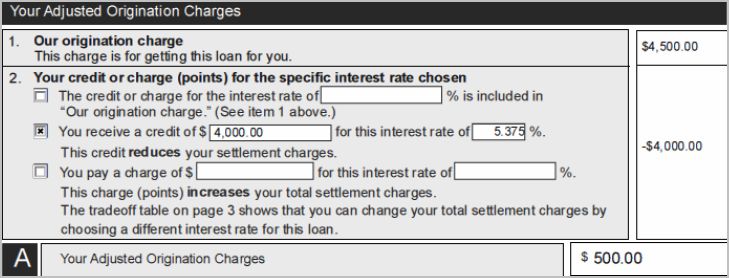

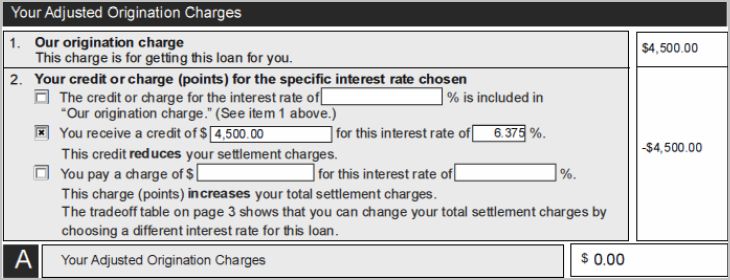

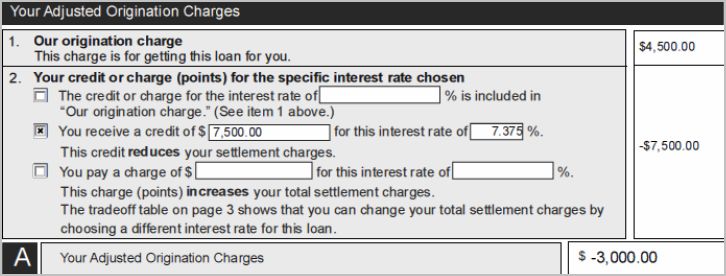

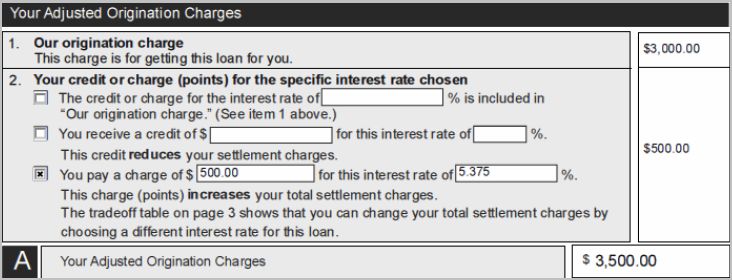

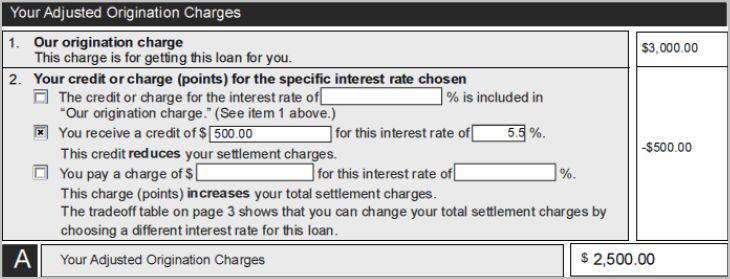

Block A - Disclosure of Adjusted Origination Charge

Block A addresses disclosure of origination charges, which include all lender and mortgage broker charges. The “adjusted origination charge” results from the subtraction of a “credit” from the “origination charge” or the addition of a “charge” to the origination charge.

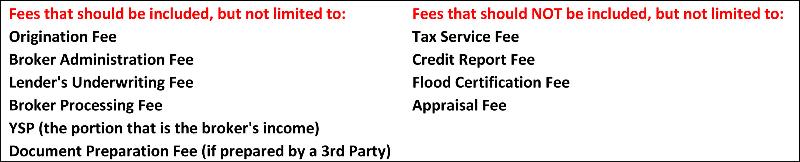

Block 1 – the origination charges, which includes lender processing and underwriting fees and any fees paid to a mortgage broker.

Note: This block requires the disclosure of all charges that all loan originators involved in the transaction will receive for originating the loan (excluding any charges for points). A loan originator may not separately charge any additional fees for getting the loan, such as application, processing or underwriting fees. The amount in Block 1 is subject to zero tolerance (i.e., the amount cannot change at settlement). (See “Tolerances” below.)

Block 2 – a “credit” or “charge” for the interest rate chosen:

Note: Differentiation is made between transactions involving a mortgage broker and transactions that do not involve a mortgage broker.

Transaction Involving a Mortgage Broker. Block 2 requires disclosure of a “credit” or charge (points) for the specific interest rate chosen. The credit or charge for the specific interest rate chosen is the net payment to the mortgage broker (i.e., the sum of all payments to the mortgage broker from the lender, including payments based on the loan amount, a flat rate or any other compensation, and in a table funded transaction, the loan amount less the price paid for the loan by the lender).

When the net payment to the mortgage broker from the lender is positive, there is a “credit” to the borrower and it is entered as a negative amount. [For example, if the lender pays a yield spread premium (YSP) to a mortgage broker for the loan set forth in the GFE, the payment must be disclosed as a “credit” to the borrower for the particular interest rate listed on the GFE (reflected on the GFE at Block 2, checkbox 2). The term “yield spread premium” is not featured on the GFE or the HUD-1 Settlement Statement.]

Note: Points paid by the borrower for the interest rate chosen must be disclosed as a “charge” (reflected on the GFE at Block 2, third checkbox). A loan cannot include both a charge (points) and a credit (yield spread premium).

Transaction Not Involving a Mortgage Broker. For a transaction without a mortgage broker, a lender may choose not to separately disclose any credit or charge for the interest rate chosen for the loan in the GFE. If the lender does not include any credit or charge in Block 2, it must check the first checkbox in Block 2 indicating that “The credit or charge for the interest rate you have chosen is included in ‘our origination charge’ above.” Only one of the boxes in Block 2 may be checked: a credit and charge cannot occur together in the same transaction.

Block B - Disclosure of Charges for All Other Settlement Services

Block B totals the sums for all settlement services (other than the origination charges).

Block 3 – service providers selected by the lender (i.e., appraisal, flood certification fees)

Block 4 – title service fees and the cost of lender’s title insurance

Block 5 – owner’s title insurance

Block 6 – other required services for which the consumer may shop

Block 7 – government recording charges

Block 8 – transfer tax charges

Block 9 – initial deposit for escrow account

Block 10 – daily interest charges

Block 11 – homeowner’s insurance charges

Third Page of GFE

The third page of the GFE includes the following information:

- Tolerance Chart: identifies the charges that can change at settlement (See “Tolerances” below.)

- Trade-Off Table: requires the loan originator to provide information on the loan described in the GFE and at the loan originator’s option, information about alternative loans (i.e., lower settlement charges but a higher interest rate, lower interest rate but higher settlement charges)

- Shopping Chart: allows the consumer to fill in loan terms and settlement charges from other lenders or brokers to use to compare loans

- Disclosure: language indicating that some lenders may sell the loan after settlement, but any fees the lender receives in the future cannot change the borrower’s loan or the settlement charges.

Binding Good Faith Estimate[x]

With limited exceptions, the loan originator will be bound to the settlement charges and loan terms listed on the GFE. For the interest rate, the loan originator will be required to indicate on the GFE the period during which a rate is available. After that period, the interest rate and other rate related charges, the adjusted origination charges, and the per diem interest can change until the interest rate is locked.

For settlement charges and all other loan terms, the loan originator will be required to honor the estimated settlement charges and loan terms for at least 10 business days from the date the GFE is provided. The charges and terms in the GFE will be binding, unless a revised GFE is provided to the borrower prior to settlement based on “changed circumstances” as defined in the rule (see below). NOTE: if a lender accepts a GFE issued by a mortgage broker, the lender is subject to the loan terms and settlement charges listed in the GFE, unless a revised GFE is issued prior to settlement.

Changed Circumstances are:

- Acts of God, war, disaster or other emergency

- Information particular to the borrower or transaction that was relied on in providing the GFE that changes or is found to be inaccurate after the GFE has been provided

- New information particular to the borrower or transaction that was not relied on in providing the GFE

- Other circumstances particular to the borrower or transaction, including boundary disputes, the need for flood insurance or environmental problems

Changed circumstances do not include: borrower’s name, borrower’s monthly income, property address, estimate property value, mortgage loan amount, and any information contained in any credit report obtained by the loan originator prior to providing the GFE (unless the information changes or is found to be inaccurate after the GFE has been provided). Also, market price fluctuations by themselves do not constitute changed circumstances.

Changed circumstances affecting settlement costs are those circumstances that result in increased costs for settlement services such that the charges at settlement would exceed the tolerances or limits on those charges established by the regulations.

Changed circumstances affecting the loan are those circumstances that affect the borrower’s eligibility for the loan. For example, if underwriting and verification indicate that the borrower is ineligible for the loan provided in the GFE, the loan originator would no longer be bound by the original GFE. In such cases, if a new GFE is to be provided, the loan originator must do so within three business days of receiving information sufficient to establish changed circumstances. The loan originator must document the reason that a new GFE was provided and must retain documentation of any reasons for providing a new GFE for no less than three years after settlement.

None of the information collected by the loan originator prior to issuing the GFE may later become the basis for a “changed circumstance” upon which it may offer a revised GFE, unless:

1) it demonstrates that there was a change in the particular information; or

2) the information was inaccurate; or

3) it did not rely on that particular information in issuing the GFE.

A loan originator has the burden of demonstrating non-reliance on the collected information, but may do so through various means (for example, through a documented record in the underwriting file or an established policy of relying on a more limited set of information in providing GFEs).

NOTE: if a loan originator issues a revised GFE based on information previously collected in issuing the original GFE and “changed circumstances,” it must document the reasons for issuing the revised GFE, such as its non-reliance on such information or the inaccuracy of such information.

Tolerances on settlement costs[xi]

Established “tolerances” or limits are placed on the amount actual settlement charges can vary at closing from the amounts stated on the Good Faith Estimate. Three tolerance categories of settlement charges are disclosed. At settlement, if the charges exceed the charges listed on the GFE by more than the permitted tolerances, the loan originator must cure the tolerance violation, at settlement or within 30 calendar days after settlement, by reimbursing to the borrower the amount by which the tolerance was exceeded.

Tolerance Categories

1. Zero tolerance category. This category of fees is subject to a zero tolerance standard. The fees estimated on the GFE may not be exceeded at closing. These fees include:

- the loan originator’s own origination charge, including processing and underwriting fees

- the credit or charge for the interest rate chosen (i.e., yield spread premium or discount points) while the interest rate is locked

- the adjusted origination charge while the interest rate is locked

- state/local property transfer taxes

2. Ten percent tolerance category. For this category of fees, while each individual fee may increase or decrease, the sum of the charges at settlement may not be greater than ten (10%) percent above the sum of the amounts included on the GFE. These fees include:

- loan originator required settlement services, where the loan originator selects the third-party settlement service provider

- loan originator required services, title services, required title insurance and owner’s title insurance when the borrower selects a third-party provider identified by the loan originator

- government recording charges

3. No tolerance category. This category of fees is not subject to any tolerance restriction. The amounts charged for the following settlement services included on the GFE can change at settlement and the amount of the change is not limited. These fees include:

- loan originator required services where the borrower selects his or her own third-party provider

- title services, lender’s title insurance and owner’s title insurance when the borrower selects his or her own provider

- initial escrow deposit

- daily interest charges

- homeowner’s insurance

HUD-1/1A Settlement Statement[xii]

The revised HUD-1/1A Settlement Statement form provides a reference between the HUD-1/1A and the relevant line from the GFE.[xiii] (Inadvertent or technical errors on the HUD-1/1A will not be deemed to be a violation of RESPA, if a revised HUD-1/1A is provided to the borrower within 30 days of settlement.)

Key Enhancements

There are no substantive changes to the first page of the HUD-1/1A form. However, there are changes to the second page of the form to facilitate comparison between the HUD-1/1A and the GFE, as indicated above. Each designated line on the second page of the revised HUD-1/1A includes a reference to the relevant line from the GFE.

- No Cost Loans. Where “no cost” refers only to the loan originator’s fees (see Section L, subsection 800 of the HUD-1 form), the amounts shown for the “origination charge” and the “credit or charge for the interest rate chosen” should offset, so that the “adjusted origination charge” is zero. Where “no cost” encompasses loan originator and third-party fees, all third-party fees must be itemized and listed in the borrower’s column on the HUD-1/1A. These itemized charges must be offset with a negative adjusted origination charge (Line 803) and recorded in the columns.

- Comparisons. The revised HUD-1 includes a new third page (second page of the HUD-1A) that allows borrowers to compare the loan terms and settlement charges listed on the GFE with the terms and charges listed on the closing statement. The first half of the third page includes a comparison chart that sets forth the settlement charges from the GFE and the settlement charges from the HUD-1 to allow the borrower to easily determine whether the settlement charges exceed the charges stated on the GFE.[xiv]

- As indicated above, inadvertent or technical errors on the settlement statement are not deemed to be a violation of Section 3500.4 of RESPA if a revised HUD-1/1A is provided to the borrower within 30 calendar days after settlement.[xv]

- The second half of the third page sets forth the loan terms for the loan received at settlement in a format that reflects the summary of loan terms on the first page of the GFE, but with additional loan related information that would be available at closing. A note at the bottom of the page indicates that the borrower should contact the lender if the borrower has questions about the settlement charges or loan terms listed on the form.

- Section 3500.8(b) of RESPA (“Charges to be stated”) and the instructions for completing the HUD-1/1A Settlement Statement provide that the loan originator shall transmit sufficient information to the settlement agent to allow the settlement agent to complete the “loan terms” section. (The loan originator must provide the information in a format that permits the settlement agent to enter the information in the appropriate spaces on the HUD-1/1A, without having to refer to the loan documents.)

Settlement Cost Booklet[xvi]

A loan originator is required to provide the borrower with a copy of the Settlement Cost Booklet, entitled “Shopping for Your Home Loan,” at the time a written application is submitted, or no later than three business days after the application is received. (If the application is denied before the end of the three-business-day period, the loan originator is not required to provide the booklet.) If the borrower uses a mortgage broker, the broker rather than the lender, must provide the booklet. The booklet does not need to be provided for refinancing transactions, closed-end subordinate lien mortgage loans, and reverse mortgage transactions, or for any other federally related mortgage loan not intended for the purchase of a one-to-four family residential property.

[i] 73 Fed. Reg. 68204 (Nov. 17, 2008).

[ii] Regulatory Compliance Outlook, National Mortgage Professional Magazine, December 2009, Volume 1, Issue 8,

[iii] For detailed information, review the following Appendices from the RESPA regulation: Appendix A – Instructions for completing the HUD-1 and HUD-1A; Appendix C – Instructions for completing the Good Faith Estimate (GFE).

[iv] Lenders are responsible for the disclosures provided by mortgage brokers and, therefore, should implement procedures to assure that mortgage brokers with whom they do business comply with the new RESPA requirements.

[v] HUD issued the revised Settlement Cost Booklet on December 15, 2009. Entitled “Shopping for Your Home Loan,” the new booklet must be used with the new GFE and HUD–1.

[vi] Portions of this overview incorporate guidance from OTS: Consumer Affair Laws and Regulations, Section 1320.1 (12/2009)

[vii] The GFE must be completed in accordance with the Instructions set forth in Appendix C of 24 CFR Part 3500.

[viii] The RESPA Reform Rule changed the definition of “mortgage broker” to mean a person or entity (not an employee of a lender) that renders origination services and serves as an intermediary between a lender and a borrower in a transaction involving a federally related mortgage loan, including such person or entity that closes the loan in its own name and table funds the transaction. The definition will also apply to a loan correspondent approved under 24 CFR 202.8 for Federal Housing Administration (FHA) programs. The definition would also include an “exclusive agent” who is not an employee of the lender.

[ix] Weekdays, except Sundays and specified, legal Holidays.

[x] See: 24 CFR 3500.7(f)

[xi] See: 24 CFR 3500.7(e) and (i)

[xii] See: 24 CFR 3500.8

[xiii] No settlement statement is required for home equity plans subject to the Truth in Lending Act and Regulation Z.

[xiv] If any charges at settlement exceed the charges listed on the GFE by more than the permitted tolerances, the loan originator may cure the tolerance violation by reimbursing to the borrower the amount by which the tolerance was exceeded. A borrower will be deemed to have received timely reimbursement if the financial institution delivers or places the payment in the mail within 30 calendar days after settlement.

[xv] See: 24 CFR 3500.4: Reliance upon Rule, Regulation or Interpretation by HUD

[xvi] Op. Cit. 5