Technical Corrections and Clarifying Amendments

Federal Register - Vol. 76, No. 132

Monday, July 11, 2011

LENDERS COMPLIANCE GROUP® is the country's first full-service mortgage risk management firms in the United States, devoted to offering a full suite of services in residential mortgage banking, respectively, to banks and nonbanks, independent mortgage professionals, and mortgage servicers. We also provide state-of-the-art mortgage quality control auditing and loan analytics.

CREATORS OF THE COMPLIANCE TUNE-UP®

AARMR | ABA | ACAMS | ALTA | ARMCP | IAPP | IIA | MBA | MERS® | MISMO | NAMB

Since the introduction of the effective implementation date of the new Good Faith Estimate (GFE) on January 1, 2010, we have been working closely with our clients to assure proper disclosure compliance. During this time, we have documented literally hundreds of issues that have required resolution and guidance pertaining not only to the GFE but also the new HUD-1 Settlement Statement (HUD-1).

Even now, these many months into the use of the new GFE, we receive numerous requests from clients seeking a better understanding of this form's nuances and requirements.

Regarding proper implementation of the GFE and HUD-1, we have compiled a database of resolutions and guidelines for regulatory compliance, and will soon make it available to our clients in the first release of our online client website.

However, there are still gaps and we look to the Department of Housing and Urban Development (HUD) for further written clarifications.

There have been eight (8) updates to the New RESPA Rule FAQs (RESPA FAQs) since HUD issued the Final Rule on November 17, 2008: six were issued in 2009, and two were issued in 2010 - with the second (and most recent) issued on April 2, 2010. Although HUD issued a RESPA Roundup in July, that document provided virtually no GFE guidance.

Given that the last RESPA FAQs update was in early April, another update is long overdue. HUD should update the RESPA FAQs soon.

We thought we'd share with you some mistakes made by mortgage brokers and the positions taken by our wholesale lending clients in response to those errors. Obviously, our retail mortgage banker clients have different issues and disclosure concerns. Nevertheless, wholesale lending has certain issues quite unique to the origination and loan flow processes.

Highlights

Top 10 GFE Mistakes Made By Brokers

1. Broker submits a 2009 GFE. The 2010 HUD-approved GFE is the only version acceptable to the lender. Obviously, this mistake was happening during the early transition period, but the percentage of occurrences was inordinately high at the time.

2. Broker submits a 2010 GFE without a complete Service Provider List. All GFEs must include a Service Provider List and must clearly indicate all services that the broker has chosen for the borrower if the broker is selecting the provider. If the borrower chooses from the service provider(s) or if the broker chooses the service provider(s) the 10% tolerance must be adhered to.

3. Broker includes the YSP in Line #1, but leaves Line #2 completely blank. Line 2 should always be the Gross YSP. The adjustment for what the broker wants to make as income and what the broker would like to credit the borrower is adjusted in Line 1.

Here's an example taken from our files:

4. Broker includes the YSP in Line #2, but fails to include it in Line #1. The adjustment for what the broker wants to make as income and what the broker would like to credit the borrower is adjusted in Line 1.

Here's an example taken from our files:

5. Broker does not disclose the lender's underwriting fee in Line #1. The lender's underwriting fee should be included in Line #1.

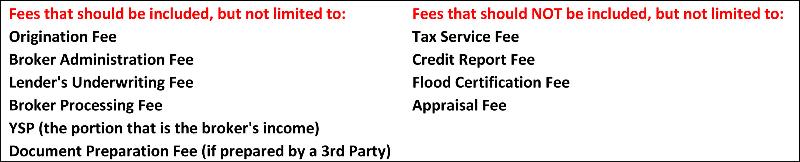

6. Broker leaves Line #1 completely blank or is calculated incorrectly. Line #1 should include all income fees for the broker and lender.

Here's an outline taken from our files:

7. Broker does not include 3rd party fees in Line #3. Third party fees, including lender's fees [i.e., Tax Service Fee, Flood Certification Fee, Appraisal Fee (even if it is paid outside of closing), Credit Report Fee, FHA Upfront Mortgage Insurance Premium (MIP) Fee VA Funding Fee, and so forth], should be included in Line #3.

8. Broker does not disclose any and all seller paid items. All fees should be included on the GFE even if the seller is paying closing costs.

9. Broker does not include the transfer tax fees on the GFE in states where transfer tax is a requirement. The transfer tax fees must be disclosed in states where required. If state or local law is unclear or does not specifically attribute transfer tax to a seller or the borrower, the amount to be disclosed by the broker is governed by common practice or experience in the locality. Because not disclosing this fee is in the zero tolerance box, our wholesale lenders charge the broker if not disclosed upfront.

10. Broker does not include all income fees in Box 1 including the lender's underwriting fee. All broker income fees must be included in Box 1 along with the lender's underwriting fee. No additional fees can be added after the initial GFE.

Visit Library for Issuances

New Good Faith Estimate and HUD-1 Settlement Statement

RESPA - Final Rule and New RESPA Rule FAQs

Lenders Compliance Group is the first full-service, mortgage risk management firm in the country, specializing exclusively in mortgage compliance and offering a full suite of hands-on and automated services in residential mortgage banking.