LENDERS COMPLIANCE GROUP® is the country's first full-service mortgage risk management firms in the United States, devoted to offering a full suite of services in residential mortgage banking, respectively, to banks and nonbanks, independent mortgage professionals, and mortgage servicers. We also provide state-of-the-art mortgage quality control auditing and loan analytics.

CREATORS OF THE COMPLIANCE TUNE-UP®

AARMR | ABA | ACAMS | ALTA | ARMCP | IAPP | IIA | MBA | MERS® | MISMO | NAMB

Monday, November 19, 2018

Identity Theft Prevention: How to Catch a Thief

Friday, August 23, 2013

Mortgage Fraud: Data Confirms Spike in 2006-2007

Time Elapsed from Activity Date to Reporting Date

with and without the Term “Repurchase” in Narrative

with Term “Foreclosure Rescue” in Narrative, 2003-2012

Thursday, February 14, 2013

Anti-Money Laundering–Red Flags and the SAR Narrative

Monday, November 5, 2012

FinCEN: SAR Narrative, PowerPoint, and Mortgage Loan Fraud

Thursday, August 23, 2012

Mortgage Fraud and SARs

Thursday, May 10, 2012

The SAR catches a RAT

Tuesday, November 8, 2011

CFPB Issues “Early Warning Notice” Procedures

-Be submitted on 8.5 by 11 inch paper

-Double spaced

-At least 12-point type

-No longer than 40 pages

-Be received by the CFPB no more than 14 calendar days after the Notice.

Bulletin 2011-04

November 7, 2011

Bulletin 2011-04

November 7, 2011

Friday, May 13, 2011

Wells Fargo's "Seventeen Worthless Mortgages"

COMMENTARY: by JONATHAN FOXX

2) FMI then sends the necessary mortgage documents to TitlePro.

2) TitlePro then uses the loan documents to create the appearance of loan closings (i.e., completing a HUD-1 Settlement Statement, et cetera).

3) TitlePro is now able to obtain funds from FMI's warehouse lenders (which does not include Wells Fargo).

4) After obtaining the funds, TitlePro fails to use those funds to clear title or pay off the pre-existing mortgage.

5) TitlePro transfers the funds to FMI.

6) For many transactions, FMI also creates multiple, unrecorded "first" mortgages on each property by having borrowers sign multiple sets of "original" loan documents at closing. (I'll call these "first" mortgages "bogus mortgages.")

7) FMI fabricates the notes.

8) FMI sells these unrecorded bogus mortgages to several secondary investors, including Wells Fargo.

9) In each of these transactions, FMI fails: (a) to disclose the existence of the other bogus mortgages with prior liens to purchasers of these mortgages and (b) to record the mortgages it subsequently sold.

10) Wells Fargo deals with FMI exclusively, sending payment for the notes directly to FMI's accounts.

11) Wells Fargo does not interact with TitlePro or Old Republic in any way.

2) The HUD-1 Settlement Statements requires TitlePro to use these funds to pay off the prior mortgages on the properties.

3) TitlePro fails to pay off the prior mortgages and release them of record.

4) TitlePro also fails to record the new mortgage in favor of FMI that "secured" the notes eventually sold to Wells Fargo.

5) In each of these transactions, FMI fails: (a) to disclose the existence of the other bogus mortgages with prior liens to purchasers of these mortgages and (b) to record the mortgages it subsequently sold.

6) Old Republic does not issue policies on these transactions, because Old Republic's Commitment letters requires the prior mortgages to be "paid and released of record" as a condition of issuing the title insurance policies.

7) For some of these transactions, Old Republic also issues a standard-form closing protection letter (CPL), agreeing to reimburse FMI for losses arising out of an issuing agent's misconduct in closing a transaction.

Wednesday, March 30, 2011

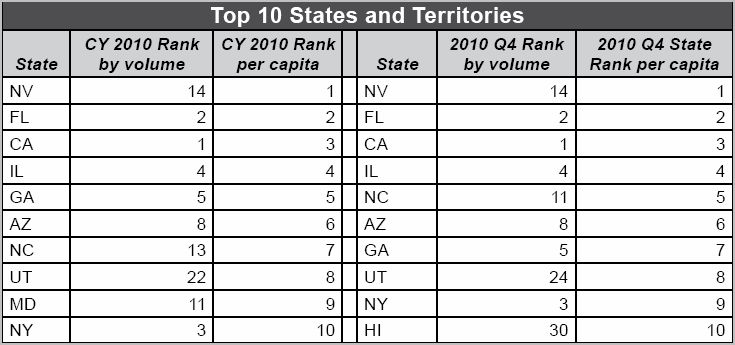

FinCEN: 2010 Mortgage Fraud Report

SARs from January 1, 2010 to December 31, 2010

Issued: March 28, 2011

Friday, January 7, 2011

FHA: Updates Quality Control Requirements

On January 5, 2011, HUD-FHA issued Mortgagee Letter 2011-02, which clarifies quality control requirements relating to several important areas: (1) due to recent changes to the lender eligibility criteria for participation in FHA programs (i.e., "Helping Families Save Their Homes Act of 2009" (HFSH Act)); (2) "Continuation of FHA Reform: Strengthening Risk Management through Responsible FHA-approved Lenders" (Final Rule FR 5356-F-02); and, (3) Mortgagee Letter 2010-20.

Additionally, this Mortgagee Letter clarifies Quality Control requirements for servicing transfers and loan sales, reporting of fraud and material deficiencies, and the required timeframes for mortgagees to review rejected applications.

Especially if you are a Sponsoring Third Party Originator, we urge you to revise your Quality Plan immediately and implement the requirements contained in Mortgagee Letter 2011-02.

Effective: Immediately

SPONSORING THIRD PARTY ORIGINATORS

Beginning January 1, 2011, FHA will neither approve applications for approval as a loan correspondent, nor monitor lenders acting in such capacity for the purpose of the origination of loans submitted for FHA insurance. All lending entities performing in the capacity of a loan correspondent will thereafter be referred to as Sponsored Third Party Originators.

Consequently, all FHA-approved mortgagees will be responsible for performing quality control reviews of their Sponsored Third Party Originators.

The procedures used to review and monitor Sponsored Third Party Originators must be included in a mortgagee's FHA-approved Quality Control Plan.

Therefore, the Quality Control Plan must be reviewed and, where required, revised with respect to the review of loans originated and sold to the mortgagee by each of its Sponsored Third Party Originators.

- Mortgagees must determine the appropriate sample amount of each Sponsored Third Party Originator's loans to review based on volume, past experience, and other factors specified by the Department in Paragraph 7-6(C) of HUD Handbook 4060.1, REV-2.

- Sponsors must document the methodology used to review Sponsored Third Party Originators, the results of each review, and any corrective actions taken as a result of their review findings.

A report of the Quality Control review and follow-up that includes the review findings and actions taken, and the procedural information (such as the percentage of loans reviewed, basis for selecting loans, and who performed the review), must be retained by the mortgagee for a period of two years.

EARLY PAYMENT DEFAULTS

In addition to the loans selected for routine quality control reviews, mortgagees must review all loans that are originated or underwritten by their company and that are originated by their Sponsored Third Party Originators that go into default within the first six payments (referred to as early payment defaults). (Handbook 4060.1, REV-2 defines early payment defaults as loans that become 60 days past due within the first six payments.)

- Mortgagees must perform reviews of early payment defaults within 45 days from the end of the month the loan is reported as 60 days past due.

- The Early Payment Default review report and follow-up, including review findings and any actions taken, along with procedural information (as specified in HUD Handbook 4060.1 Rev.-2, Paragraph 7-6 (E)), must be retained by the mortgagee for a period of two years.

SALES AND TRANSFER OF LOANS

Mortgagees are responsible for determining whether the Mortgage Change Record was reported accurately to HUD via the FHA Connection on servicing transfers or sales of loans. Mortgagees' Quality Control Plans must contain a requirement to ensure the review of all Mortgage Change Records for accuracy, as follows:

For cases involving the transfer of legal rights to service FHA-insured loans:

- The transferee must report the change of legal rights to service to HUD The transferor should verify that the change of legal rights to service has been reported, and that all details contained in the report are accurate.

For cases involving the holder's sale of loans:

- The holder (seller) must report the sale of loans to HUD The buyer must confirm that the sale of loans has been reported, and that all details contained in the report are accurate.

REPORTING OF FRAUD OR MATERIAL DEFICIENCIES

If a mortgagee discovers potential fraud or other serious material deficiencies, it must be immediately reported to the HUD via the Neighborhood Watch Early Warning System (see: Handbook 4060.1 Rev.-2, Paragraph 7-3 (J)).

- Management is expected to review and respond accordingly to each instance of fraud or other serious material deficiency, indicating what steps if any have been taken to cure and/or resolve these violations.

- All corrective actions taken in response to instances of fraud or other serious material deficiencies should be reported to the Department via the Neighborhood Watch Early Warning System.

- Mortgagees must monitor all loans they originate, underwrite or service for potential fraud or serious material deficiencies throughout the lifecycle of the loans.

REJECTED APPLICATIONS

Rejected applications must be reviewed within 90 days from the end of the month in which the decision was made.

Visit Library for Issuance

Quality Control Requirements for Direct Endorsement Lenders

Mortgagee Letter 2011-02

January 5, 2011

LENDERS COMPLIANCE GROUP is the first full-service, mortgage risk management firm in the country, specializing exclusively in mortgage compliance and offering a full suite of hands-on and automated services in residential mortgage banking.

Wednesday, December 15, 2010

FinCEN: 7% Increase in Mortgage Fraud

One report covers January through March 2010, and the other covers April through June 2010.

For previous announcements on this subject, please visit the Compliance ALERTS section of our Archive.

Taken together the reports show that suspicious activity reports (SARs) indicating mortgage loan fraud (MLF) climbed 7%, rising to 35,135 in the first half of 2010 compared with 32,926 in the first half of 2009.

In part, the increase is being attributed to increased attention to older loans spurred by repurchase demands.

In the first quarter of 2010, 78% of reported activities occurred more than two years prior to filing, compared with 44% in the same period of 2009, showing a continued focus on loans originated from 2006 to 2008.

First Quarter

Second Quarter

Key Findings

References to bankruptcy in SARs have steadily increased, rising to 7% of MLF SAR filings in 2010, compared to 1% in 2006 and 2007.

SAR reports referencing "short sale" and "broker price opinion" appeared 827 times and 41 times in SARs respectively during the first quarter of 2010. (Short sales and broker price opinions mentioned in SARs are sometimes associated with a particular type of flipping scheme known as "flopping." Flopping occurs when a foreclosed property is sold at an artificially low price to a straw buyer, who quickly sells the property at a higher price and pockets the difference.)

Visit Library for Issuances

FinCEN: Suspicious Activity Report Filings from January 1-March 31, 2010, Mortgage Loan Fraud Update, December 2010

FinCEN: Suspicious Activity Report Filings from April 1-June 30, 2010, Mortgage Loan Fraud Update, December 2010

LENDERS COMPLIANCE GROUP is the first full-service, mortgage risk management firm in the country, specializing exclusively in mortgage compliance and offering a full suite of hands-on and automated services in residential mortgage banking.

Tuesday, December 7, 2010

FinCEN: Proposes Non-Bank Lenders File SARs

On December 6, 2010, the Financial Crimes Enforcement Network (FinCEN) proposed a requirement that non-bank residential mortgage lenders and originators, just like other types of financial institutions, establish anti-money laundering (AML) programs and comply with suspicious activity report (SAR) regulations. The requirements are provided in a Notice of Proposed Rulemaking.

The Bank Secrecy Act (BSA) authorizes the Treasury to issue regulations requiring financial institutions to keep records and file reports that the Secretary determines "have a high degree of usefulness in criminal, tax, or regulatory investigations or proceedings, or in the conduct of intelligence or counterintelligence activities, including analysis, to protect against international terrorism." The subject proposed rulemaking regarding residential mortgage lenders is derived from that authority.

At this time, the only mortgage originators that are required to file SARs are banks and insured depository institutions.

According to FinCEN, analyses of SARs in FinCEN's mortgage fraud reports show that non-bank mortgage lenders and originators initiated many of the mortgages that were associated with SAR filings.

The Notice of Proposed Rulemaking intends to provide prevention of mortgage fraud, including such activities as false statement, use of straw buyers, fraudulent flipping, and even identity theft associated with mortgage borrowing. These illegal activities, and others, have been identified in information provided by SARs.

This Notice of Proposed Rulemaking was informed by comments received following an Advanced Notice of Proposed Rulemaking (ANPRM) issued last year on July 21, 2009.

Comments: Due 30 days after publication in the Federal Register.

Lenders Compliance Group provides a robust and comprehensive risk assessment for auditing SARs. If you would like to prepare for the SARs filing requirements and/or provide independent testing and monitoring for compliance, please contact us.

Minimum Requirements

(1) Policies and Procedures: incorporate policies, procedures, and internal controls based upon the loan or finance company's assessment of the money laundering and terrorist financing risks associated with its products and services.

Policies, procedures, and internal controls must:

(i) Include provisions for complying with the applicable requirements of Subchapter II of Chapter 53 of Title 31, United States Code ("Records and Reports on Monetary Instruments Transactions"),

(ii) Integrate the company's agents and brokers into its anti-money laundering program, and

(iii) Obtain all relevant customer-related information necessary for an effective anti-money laundering program.

(2) Compliance Officer: designate a compliance officer who will be responsible for ensuring that:

(i) The anti-money laundering program is implemented effectively, including monitoring compliance by the company's agents and brokers with their obligations under the program;

(ii) The anti-money laundering program is updated as necessary; and

(iii) Appropriate persons are educated and trained.

(3) Training: provide for on-going training of appropriate persons concerning their responsibilities under the program.

A loan or finance company may satisfy this requirement with respect to its employees, agents, and brokers by:

(i) Directly training such persons or

(ii) Verifying that such persons have received training by a competent third party with respect to the products and services offered by the loan or finance company.

(4) Independent Testing: provide for independent testing to monitor and maintain an adequate program, including:

(i) Testing to determine compliance of the company's agents and brokers with their obligations under the program.

(ii) Determining that the scope and frequency of the testing is commensurate with the risks posed by the company's products and services.

NOTE: Such testing may be conducted by a third party or by any officer or employee of the loan or finance company.

(5) Compliance: compliance is subject to examination by FinCEN or its delegates, under the terms of the Bank Secrecy Act. Failure to comply with the requirements may constitute a violation of the Bank Secrecy Act.

(6) Effective date: an anti-money laundering program that complies with the all requirements must be implemented on or before the later of six (6) months from the effective date of the regulation, or six (6) months after the date a loan or finance company is established and becomes subject to the requirements.

Visit Library for Issuances

FinCEN: Anti-Money Laundering Program and Suspicious Activity Report

Filing Requirements for Residential Mortgage Lenders and Originators

Notice of Proposed Rulemaking (12/6/10)

FinCEN: Advance Notice of Proposed Rulemaking

Federal Register, Vol. 74, No. 138 (7/21/09)

LENDERS COMPLIANCE GROUP is the first full-service, mortgage risk management firm in the country, specializing exclusively in mortgage compliance and offering a full suite of hands-on and automated services in residential mortgage banking.