On August, 13, 2010, Fannie Mae clarified certain aspects of its Loan Quality Initiative requirements stated in its March 2, 2010 Announcement (SEL-2010-01).

In the March update, Fannie "required lenders to determine that all debts of the borrower incurred or closed up to and concurrent with the closing of the subject mortgage are disclosed on the final loan application and included in the qualification for the subject mortgage loan."

An unintended consequence of Announcement SEL-2010-01 was the interpretation by some lenders that Fannie Mae was implementing a new requirement that the borrower be re-qualified up until closing. Indeed, we have worked with lenders that were asked by investors to repurchase loans because the former did not re-underwrite prior to closing for undisclosed liabilities that had led to excessive income ratios - even though, prior to closing, the lenders had not updated credit and had no knowledge that the borrowers had undisclosed liabilities. We successfully rebutted these repurchase demands, but Fannie's update lingered.

Many lenders believed that the March update required a new credit report just before the closing of the loan. The new Announcement (SEL-2010-11) now states that "this was not Fannie Mae's intent."

Fannie Mae has affirmed that lenders are not required to obtain a new credit report just before closing to check whether a borrower has taken out additional debt. If a borrower discloses or the lender discovers additional debt and/or reduced income after the initial underwriting decision was made, lenders are required to determine if a mortgage loan must be submitted for re-underwriting.

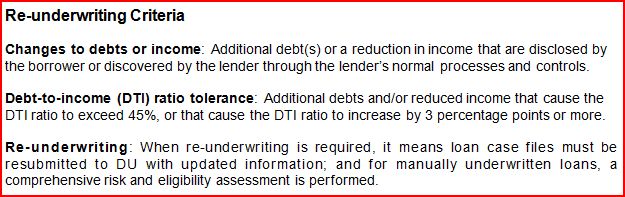

A re-underwriting will be required if the borrower discloses or the lender discovers additional debt(s) and/or reduced income after the underwriting decision was made up to and concurrent with the loan closing. The lender is not required to obtain a new credit report to verify the additional debt(s).

Still, a lender would be well advised to notify the borrower not to shop for a loan or take on additional debt between the time of the mortgage application and the closing date.

Effective Date

The new Announcement SEL-2010-11 replaces the undisclosed liabilities policy communicated in Announcement SEL-2010-01.

Compliance with the change is immediate, but must apply on loan applications dated on or after December 1, 2010.

| |

_____________________________________

Highlights

Re-underwriting Requirements

The requirements address when a lender has to re-underwrite a mortgage loan after the underwriting decision has been made up to and concurrent with loan closing for both Desktop Underwriter® (DU®) and manually underwritten mortgage loans, and includes a new re-underwriting tolerance for manually underwritten loans and simplification and expansion of the DU resubmission policy.

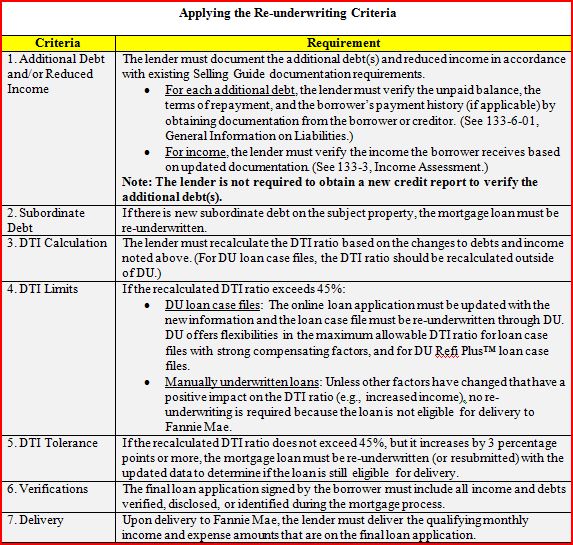

Applying the Re-underwriting Criteria

Fannie requires the following steps to be taken if the borrower discloses or the lender discovers additional debt(s) and/or reduced income after the underwriting decision was made up to and concurrent with loan closing.

Changes to the DU Resubmission Policy

The following table describes the changes to the DU tolerances and resubmission requirements. The other tolerances in the Selling Guide remain unchanged (decreases to the interest rate, increases in income, changes to assets, and loan amount changes.

___________________________________

Visit Library for Issuance

Undisclosed Liabilities and Re-underwriting Requirements

Fannie Mae: Announcement SEL-2010-11

August 13, 2010

Lenders Compliance Group is the first full-service, mortgage risk management firm in the country, specializing exclusively in mortgage compliance and offering a full suite of hands-on and automated services in residential mortgage banking.