FHA-approved mortgagees and their employees must comply with the NMLS registration requirements of the states and entities with jurisdiction over their activities, and must register in accordance with the guidelines set forth by the NMLS.

Additionally, Sponsoring Third Party Originators are now required to ensure that their Sponsored Third Party Originators obtain and maintain an NMLS unique identifier (NMLS ID), as is required by the states and entities with jurisdiction over their activities and in accordance with the registration guidelines set forth by the NMLS.

Please also note that under the Helping Families Save Their Homes Act of 2009 (Pub.L. 111-22), the failure of an FHA-approved lender to comply with requirements of the Safe Act (12 U.S.C. 5101-5116) and applicable state law is cause for withdrawal of FHA lender approval or loss of authorization to participate in FHA lending programs.

HUD expects mortgagees to comply with applicable federal and state requirements governing NMLS licensing and registration. For more information on your state's NMLS requirements and implementation plans, you can visit the NMLS Resource Center.

HUD will capture NMLS IDs at a number of points in the lender approval and loan origination processes, which we have indicated below.

Read Below for Compliance Deadlines.

DATA CAPTURE OF NMLS IDENTIFIERS

APPLICATION FOR OR RENEWAL OF FHA LENDER APPROVAL

HUD will collect the NMLS company ID:

- From lenders seeking approval to participate in FHA programs via a new field in the "Application for Federal Housing Administration Lender Approval" (Form HUD-92001-A). The revised Form HUD-92001-A is expected to be released soon and available on HUD's document website.

- From lenders seeking to renew their FHA lender approval via the completion of a new field in the renewal screens in FHA Connection. Changes to the renewal screens in FHA Connection were released on October 4, 2010.

Completion of these new fields will become mandatory upon their release for those institutions that possess an NMLS company ID.

SPONSORING THIRD PARTY ORIGINATORS

HUD will collect the NMLS company ID of Sponsored Third Party Originators:

From Sponsoring Third Party Originators, by their completing the Sponsored Originator Maintenance screen in FHA Connection.

LOAN PROCESSING AND UNDERWRITING

Mortgagees will be required to complete the following new fields on the FHA Connection case number assignment screen, as appropriate:

1) Loan Officer: the NMLS ID of the loan officer who took the application from the applicant.

We expect this information to be used, among other things, to observe and enforce compliance with loan officer licensing requirements. Disclosure compliance regarding this data will likely be included in HUD's quality assurance examinations.

2) Sponsored Third Party Originator loans: the Sponsored Third Party Originator's company name and Taxpayer Identification Number (if applicable).

HUD will use the information to provide the Sponsoring Third Party Originators with Neighborhood Watch performance data for their Sponsored Third Party Originators. We expect the information to be used by HUD to assist in ensuring that participants in FHA loan transactions comply with the eligibility requirements governing participation in FHA programs.

Compliance Dates

Until March 31, 2011: entry of the name and NMLS ID of a loan officer is optional.

On and after April 1, 2011: the information must be entered in accordance with the following guidelines:

-The loan officer's first and last name are required, and

-If registered in NMLS, the loan officer's NMLS ID is required.

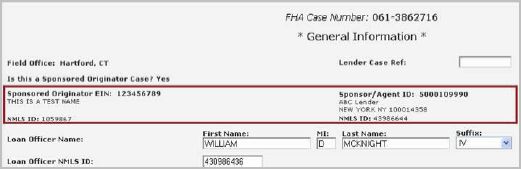

Here's a screen shot:

FHA Case Number Screen - General Information

HUD/VA ADDENDUM TO UNIFORM RESIDENTIAL LOAN APPLICATION

(HUD 92900-A)

Changes have been made to form HUD 92900-A, "HUD/VA Addendum to Uniform Residential Loan Application," to capture the company name, Taxpayer Identification Number and NMLS ID (if applicable) of a Sponsored Third Party Originator company.

Sponsoring Third Party Originator mortgagees may obtain the revised form at HUD's document website.

HUD 92900-A (9/2010): must be used for all loan applications taken by a Sponsored Third Party Originator.

HUD 92900-A (5/2008): may be used for loan originations not involving a sponsored originator until January 1, 2011.

Visit Library for Issuance

FHA Capture of Nationwide Mortgage Licensing System and Registry (NMLS) Information

Mortgagee Letter 2011-04

January 5, 2011

LENDERS COMPLIANCE GROUP is the first full-service, mortgage risk management firm in the country, specializing exclusively in mortgage compliance and offering a full suite of hands-on and automated services in residential mortgage banking.