By: Jonathan Foxx, President and Managing Director

Published in National Mortgage Professional Magazine

First Published: August 2010

Who’s In Charge Here?

I never blame myself when I'm not hitting.

I just blame the bat and if it keeps up, I change bats.

After all, if I know it isn't my fault that I'm not hitting, how can I get mad at myself?

Yogi Berra

I just blame the bat and if it keeps up, I change bats.

After all, if I know it isn't my fault that I'm not hitting, how can I get mad at myself?

Yogi Berra

Let’s admit it: the tendency to pretend we’re holding somebody or some entity “accountable” for the mortgage crisis, when we’re really not, is just a fashionable avoidance of that unpleasant word: “blame.” Once that label sticks, it’s on to dealing with the nasty culprits! Blaming is purported to be cowardly, even passive; and being held accountable is lauded as proactive and high-minded. So, the word “accountable” is now in vogue, instead of “blame.” Frankly, the word “accountable” in today’s world is merely politically-correct, euphemistic Newspeak for the fact that “you know you did wrong, I know you did wrong, everybody in the world knows you did wrong, but you’ll pay no penalties whatsoever for doing anything wrong.”

Although the tone-at-the-top mantra of the Obama Administration is “let’s look forward and not look back,” or the Bush Administration’s tactic of retroactively making lawful what was heretofore unlawful (or unconstitutional) remains beyond contest, or the on-going trading of opaque financial instruments seems to continue in an entirely unregulated market, or many government departments and agencies are still remaining reactive at best during a crisis – in the Newspeak of our times, we are assured of accountability, which now apparently means there’s nobody to blame at all, nobody held responsible for the meltdown, nobody to put in jail. Everybody’s free to go and, we’re admonished, it doesn’t do any good to blame anybody for anything, since we can’t fix this mortgage mess unless and until we all can get along, be bi-partisan, be post-partisan, and look to the better angels of our nature!

Accountability these days seems to mean no adverse consequences to the perpetrator and no blame for anybody. If you find a person to blame, that person’s not accountable; and if you find somebody who is accountable, that person is not to blame. While lobbyists, dogmatists, political catechists, and ideologues just make stuff up, they’ve found the culprit for sure, those bad actors portrayed as directly and indirectly culpable, the rapacious mortgage originators: they certainly should be blamed, reined in, re-regulated, and de-incentivized for having largely contributed to the worst financial crisis since the Great Depression!

Portraying mortgage originators as the culprit is a politically useful narrative meant for the consumption of low information voters; but, as we’ll see, there is plenty of blame in this game and, to date, not much real, old-fashioned accountability – the kind that has real world consequences – except, of course, for those who originated the mortgages in the first place.

Results are what you expect.

Consequences are what you get.

Anonymous

Consequences are what you get.

Anonymous

On Tuesday, June 22, 2010, a Conference Committee met in Room 106 of the Dirksen Senate Office Building, in Washington, to reconcile Senate and House versions of H.R. 4173, known as the Wall Street Reform and Consumer Protection Act. That bill ostensibly was drafted to create a new consumer financial protection “watchdog,” bring about an end to “too big to fail” bailouts, set up an early warning system to “predict and prevent” the next crisis, and bring transparency and accountability to exotic instruments such as derivatives. Led by Representative Barnie Frank (D-MA) and Senator Christopher Dodd (D-CT), the conferees reviewed and voted on new regulations as well as additions, deletions, and revisions of existing regulations.

The list of new regulations and amendments to existing regulations, consisting of thousands of pages, read like the attenuated, convoluted, cross-tabulated Index Section of a Whodunit’s Guide to the Perplexed. Seated around a large, rectangular dais, the Committee’s politicians called one another out, speechified, postured, and legislated to protect their respective constituencies, absolved themselves of ever having allowed their own politics to contribute to the financial crisis, while the Clerk recorded votes, staff members raced around, and lawyers scurried about with various and sundry red-lined versions of financial reform legislation.

On Friday, June 25, 2010, all the backroom, sub rosa, deals were ironed out, all the special interests had their way or lost their sway, and the votes tallied up mostly across party lines: Democrats – Aye; Republicans – Nay. The Ayes had it! Congratulations filled the conference chamber, Representatives and Senators praised one another, staff high-fived and hugged one another, and President Obama hailed the legislation as the “toughest financial reforms since the ones we passed in the aftermath of the Great Depression."[1] Now only House and Senate approval was needed,[2] and thence the President’s multi-pen signature, to become the law – which it did on July 21, 2010, just before noon. The legislation, now known as the Dodd-Frank Act, became the law of the land.

Among the many features of the legislation, the following was gaveled in:

· Requiring Lenders to Ensure a Borrower's Ability to Repay: Establishing a “simple federal standard” (sic) for all home loans to ensure that borrowers can repay the loans they are sold.

· Prohibiting Unfair Lending Practices: Prohibiting the financial incentives for subprime loans that “encourage lenders to steer borrowers into more costly loans,” including the bonuses known as yield spread premiums that “lenders pay to brokers to inflate the cost of loans.”

· Penalizing Irresponsible Lending: Issuing monetary penalties to lenders and mortgage brokers who don’t comply with new standards by holding them accountable for as high as three-year’s interest payments and damages plus attorney’s fees (if any), and, protects borrowers against foreclosure for violations of the new standards.

· Expanding Consumer Protections for High-Cost Mortgages: Expanding the protections available under federal rules on high-cost loans -- lowering the interest rate and the points and fee triggers that define high cost loans.

· Mandating Additional Mortgage Disclosures: Requiring lenders to disclose the maximum a consumer could pay on a variable rate mortgage, with a warning that payments will vary based on interest rate changes.

· Establishing an Office of Housing Counseling: Establishing a special office within the Department of Housing and Urban Development (HUD) to “boost homeownership and rental housing” counseling.

And, most significantly, the legislation’s centerpiece: the creation of a new agency, tucked into the Treasury and clearly under its purview:

· Bureau of Consumer Financial Protection (Bureau): Creating a regulatory and supervisory authority to examine and enforce consumer protection regulations with respect to all mortgage-related businesses, large non-bank financial companies, and banks and credit unions with greater than $10 billion in assets.

Some of these policies have been worthy of consideration, although others seem to be the result of reactive, political triage, and short-sighted (if not also short-term) fixes, without having given much thought to consequences, unintended or otherwise, on the consumer and the mortgage industry.

The Spinmeisters have already begun their Ode to Financial Reform! In this article, the first in a series of articles on the “landmark” legislation, we will un-spin and unpack the new law and seek to learn more about exactly what the Dodd-Frank Act (Act) has wrought for the mortgage industry.

Housing bubble? What housing bubble?

“Homes that are occupied may see an ebb and flow

in the price at a certain percentage level,

but you’re not going to see the collapse that you see

when people talk about a bubble.”

Barnie Frank (D-MA) June 27, 2005[3]

in the price at a certain percentage level,

but you’re not going to see the collapse that you see

when people talk about a bubble.”

Barnie Frank (D-MA) June 27, 2005[3]

The Act spans to 2,319 pages and affects almost every aspect of the financial services industry in the United States. Just the sheer size of the Act is indicative of the complexity and detailed, interlocking, regulatory authorities and mandates involved.[4] Compare this with the 31 pages of the Federal Reserve Act which became law almost one hundred years ago. The law’s size also should be taken to reflect the enormous increase in regulations in the intervening years that must be factored into or subsumed under the Act. Consider the following chart:[5]

Major Financial Legislation

Number of Pages

Number of Pages

Perhaps it would ultimately be worth all the effort put into such a prodigious and voluminous legislation if its purported objective – prevention of another financial crisis – could be expected to result from enforcement of this law. Unfortunately, it won’t!

The Act does very little to prevent the next financial crisis because, among other things, it side-steps the “too big to fail” issues, for instance, by not imposing size limits on any financial institution; offers virtually no resolution to the dysfunctional operations of the GSEs, Freddie Mac and Fannie Mae; and, fails to reinstate the Glass-Steagall Act’s wall of separation between “utility” and “casino” banking. Although it will not prevent the next financial tsunami or Black Swan,[6] implementation of the regulatory requirements of the Act will dramatically and permanently affect the way residential mortgages are originated in this country.

And if ineptitude, complacency, and failure to implement existing regulations were hallmarks of the regulatory environment prior to the Act, how will we know in advance how things are going with all these new regulatory requirements? After all, thanks to an unnoticed provision in the Act, the Securities and Exchange Commission (SEC) is now declaring itself exempt from Freedom of Information Act (FOIA) requests, one of the bulwarks of government transparency. Perhaps other government entities involved in the Act’s implementation will stake out similar positions.[7] Of course, there are periodic reports to Congress on many issues and programs; however, Congress is the domicile of politicians and they often find ways to underplay failures and exaggerate successes.

Residential Mortgage Loan Provisions

- New Rules -

- New Rules -

Analyzing this vast financial and mortgage reform legislation is a daunting prospect. Over this series of articles, we will highlight many of the Act’s components. The articles in this series on the Dodd-Frank Act are meant to provide an overview. However, this legislation is extremely detailed and extensive. Therefore, for guidance and risk management support, I recommend that you consult a residential mortgage compliance professional in developing policies and procedures to implement the Act’s requirements.

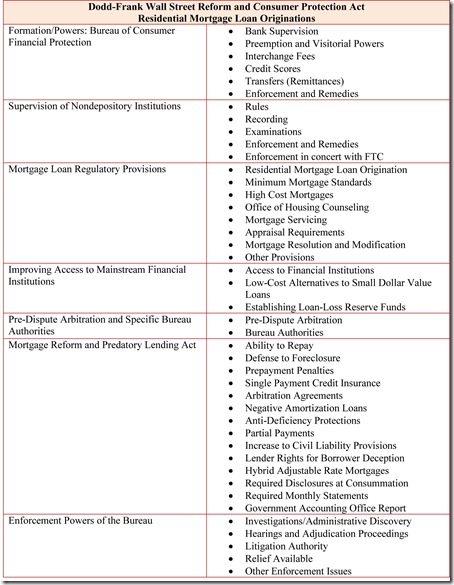

Essentially, the following matrix provides a generalized outline of the salient provisions of the Act that directly affect residential mortgage loans originations.

For the remainder of this article, we will be reviewing the Mortgage Loan Regulatory Provisions and, where relevant, its integration into other parts of the Dodd-Frank Act.

Mortgage Loan Regulatory Provisions

Residential Mortgage Loan Origination

Residential Mortgage Loan Origination

The Act revises the Truth in Lending Act (TILA) by placing restrictions on “mortgage originators.” These new requirements are promulgated in addition to those imposed by the Secure and Fair Enforcement for Mortgage Licensing Act of 2008 (SAFE Act).[8] The SAFE Act includes both registered and licensed mortgage loan originators (MLO).[9] Specifically, the Act prohibits an MLO from receiving compensation, such as a yield spread premium (YSP), based on the terms of the mortgage loan and it also effectively prevents the MLO from receiving compensation from other sources if such compensation is being otherwise received, directly or indirectly, from the consumer.

TILA, as now revised by the Act, will provide that an MLO may not receive from any person (and no person may pay to an MLO), directly or indirectly, any compensation that varies based on the terms of the loan, other than the principal loan amount. With respect to the latter, compensation is allowed to the MLO (1) based on principal amount of loan, and (2) to be financed through the loan’s rate as long as it is not based on loan’s rate and terms and the MLO does not receive any other compensation such as discount points, or origination points, or fees other than third-party charges, from the consumer (or anyone else).[10]

MLOs, therefore, are not being put out of business, but their means of deriving compensation has changed.

The Federal Reserve Board (FRB) will be issuing new rules to limit “steering” by MLOs. That is, MLOs will not be permitted to “steer” a consumer toward a residential mortgage loan that (1) the consumer lacks, or can be expected to lack, the reasonable ability to repay; (2) has any predatory characteristics;[11] and (3) promotes disparities among consumers of equal creditworthiness, but different race, ethnicity, gender or age. Steering is broadened to mean directing a consumer to a non-qualified mortgage if that consumer is qualified to receive a qualified mortgage.[12]

Furthermore, the FRB will issue rules that prohibit MLOs from misrepresenting the residential mortgage loans available to the consumer, the creditworthiness of the consumer, and the subject property’s appraised value. Unfair or deceptive acts or practices (UDAP) rules will be further strengthened through authorities given to the FRB to enforce rules prohibiting abusive or predatory practices. Importantly, MLOs will be subject to the liability standards in TILA for violations: up to treble damages - three times the compensation received by the MLO for a residential mortgage loan.

Minimum Mortgage Standards

New standards will be promulgated through the FRB which will require lenders to make a “reasonable and good faith determination, based on verified and documented information” that consumers have a “reasonable ability to repay” their mortgage loans.

In the next article in this series we will discuss the relevant criteria in extensive detail. However, in general, lenders will need to consider the consumer’s (1) credit history, (2) current income, (3) expected future income, (4) current obligations (5) debt-to-income ratio or residual income (after paying all mortgage and non-mortgage debt), (6) employment status, and (7) “any other financial resources” other than equity in the property.

Documenting all these requirements will be mandated; therefore, the lender will underwrite loans by obtaining verification of any income or assets normally used in repayment determination (i.e., tax returns, payroll receipts, bank records, and other third-party documents), but also either an IRS transcript of tax returns (i.e., 4506-T) or some other third-party income documentation method acceptable to the FRB.

High Cost Mortgages

TILA has now been revised by further defining and elaborating the features and requirements of “high cost mortgages,” which are those mortgages with annual percentage rates or points and fees exceeding thresholds stated in the Act.

With respect to high cost mortgages, lenders are (1) prohibited from encouraging default on prior debt to be refinanced in whole or in part by a high-cost mortgage, (2) limited in imposing late payment fees on delinquent payments, (3) not allowed to include balloon payments, and (4) prohibited from charging a fee to modify, renew, extend or amend the loan.

Under a due-on-sale provision, or for a material violation of the loan terms, or in the event of a default, accelerating the principal balance due is permissible. To originate a high cost mortgage, the lender must receive certification from a HUD approved counselor that the consumer has received counseling about the advisability of entering into the loan and the consumer must receive Real Estate Settlement Procedures Act (RESPA) disclosures prior to speaking with the counselor. Additionally, there are restrictions on financing prepayment penalties, points or fees.

Office of Housing Counseling

A new office and supporting bureaucracy will be created called the Office of Housing Counseling (OHC). The OHC will act in an oversight capacity to administer the counseling on home ownership, renter’s counseling, and certain educational materials. The HUD Secretary will appoint the OHC’s director and this new office will be given rulemaking authority with respect to its administrative mission. The OHC will certify counselors under the authority of certain federal housing laws.

Mortgage Servicing

The Act also amends TILA with regard to servicing, requiring a lender to establish, prior to consummation, an escrow or impounds account for most mortgage loans secured by a first lien on the consumer’s primary residence.[13] New consumer disclosures relating to an escrow or impounds account will be required.

Prohibited practices include (1) obtaining force-placed hazard insurance (unless exemptions apply), (2) charging fees for responding to valid qualified written requests (QWR) from consumers,[14] (3) delayed or belated responses to alleged payment allocation errors (i.e., response required within ten business days to an information request from a consumer relating to the owner or assignee of the loan).

Posting of payments to the consumer’s escrow or impounds account must be implemented as follows: (1) apply the payment amount to the loan account on the date of receipt; (2) within five days of receipt if the consumer does not pay in accordance with the servicer’s payment instructions; and, (3) within a reasonable time not to exceed seven business days for a payoff.

Appraisal Requirements

For higher-risk mortgages,[15] prior to extending credit and at no cost to the applicant, the lender must obtain an appraisal that includes a physical property visit. In certain circumstances, a second appraisal may be required.

New standards for appraisal independence are to be implemented and several regulatory agencies will be involved in setting rules for the registration and ensuing supervision of appraisal management companies (AMC). Automated valuation models are permitted (AVM), however new quality control requirements will be promulgated by the affected regulatory agencies.

Mortgage Resolution and Modification

The HUD Secretary will establish a program to protect tenants’ rights and multifamily properties that are at risk. The Home Affordable Modification Program (HAMP) is to receive special attention by the Treasury Secretary in a tasking to develop guidelines that permit borrowers denied a request for mortgage modification under HAMP to use borrower-related and mortgage-related data for net present value analyses (NPV). A website is to be created that offers an NPV calculator.

Other Provisions

- GAO review: a mandate for the GAO to conduct a study on interagency efforts to address mortgage foreclosure rescue scams.

- HUD review: a mandate to study the effects of the “Chinese drywall” on residential mortgage foreclosures.[16]

- Congressional review: consideration to the structural reform of Government Sponsored Enterprises (GSE), Fannie Mae and Freddie Mac.

- Funds for HUD: $1 billion in emergency mortgage assistance and $1 billion for state and local governments for the redevelopment of abandoned and foreclosed homes.

- Legal Assistance: HUD Secretary to establish a grant-making program for legal assistance to low-income and moderate-income homeowners, tenants relating to home ownership preservation, tenancy associated with home foreclosure, and also to those seeking to prevent foreclosure of their homes.

- SAFE Act registration: among amendments to the SAFE Act, the requirement to establish and maintain a system for registering employees of depository institutions (and their subsidiaries) regulated by a federal banking agency as registered loan originators with the Nationwide Mortgage Licensing System and Registry is transferred to the Bureau.

If Not Now, When?

Various authorities will be transferred to the new Bureau. Many features of the consumer protection laws will be administered by the Bureau, which will become the administrator for the “federal consumer financial laws.” In other words, nearly every existing federal consumer financial statute, as well as new consumer financial protection mandates prescribed by the Act, will become the “enumerated consumer laws” transferred to the Bureau’s authority.[17]

On the one hand, regulations will be required to be finalized within 18 months of the designated date of transfer of authority to the Bureau. Then, those regulations become effective not later than 12 months after the regulations are issued. On the other hand, some provisions do not require implementing regulations and presumably would not be subject to the above-mentioned time period – which means, therefore, that the effective compliance date for certain provisions would actually be right after the enactment of the Dodd-Frank Act. Those regulations would include the restrictions on MLO compensation, certain disclosure requirements, and changes to financial triggers on “high cost” loans under the Home Ownership and Equity Protection Act.

In the second part of this series we will discuss the Mortgage Reform and Predatory Lending Act. And, in the third and final article we will consider not only the formation and powers of the new Bureau of Consumer Financial Protection but also the overall implications of the Act for the mortgage industry.

[1] Press Release, June 25, 2010, The White House Office of the Press: "Remarks by the President on Wall Street Reform"

[2] Vote was 60 to 39. Three Republican senators -- Scott Brown (MA), Olympia J. Snowe (ME), and Susan Collins (ME) -- joined 57 members of the Democratic caucus. Senator Russell Feingold (WI) was the lone Democratic opponent, saying the measure didn't go far enough.

[3] Speech on the House Floor, June 27, 2005, In Recognition of National Homeownership Month, A Resolution (You Tube) http://bit.ly/HJAtd

[4] See Foxx, Jonathan, The CFPA Controversy: Asking the Tough Questions, in National Mortgage Professional Magazine, October 2009, Volume 1, Issue 6, pp 22-25, which recites that at least 16 consumer protection laws are affected or transferred to the Bureau, mutatis mutandis “enumerated,” including Alternative Mortgage Transaction Parity Act (AMTPA), Community Reinvestment Act (CRA), Consumer Leasing Act (CLA), Electronic Funds Transfer Act (EFTA), Equal Credit Opportunity Act (ECOA), Fair Credit Billing Act (FCBA), Fair Credit Reporting Act (except with respect to sections 615(e), 624 and 628) (FCRA), Fair Debt Collection Practices Act (FDCPA), Federal Deposit Insurance Act, subsections 43(c) through 43(f)(12) (FDIA) Gramm-Leach-Bliley Act, sections 502 through 509 (GLBA), Home Mortgage Disclosure Act (HMDA), Home Ownership and Equity Protection Act (HOEPA), Real Estate Settlement Procedures Act (RESPA), SAFE Mortgage Licensing Act (S.A.F.E. Act), Truth in Lending Act (TILA), and Truth in Savings Act (TISA).

[5] Chart by John Hall of the American Bankers Association, from “Every Death March Starts With A First Step,” Kevin Funnell, July 15, 2010, Bank Lawyer’s Blog: http://bit.ly/cQOMhb

[6] The theory of Black Swan events was developed by Nassim Nicholas Taleb to explain the disproportionate role of high-impact, hard-to-predict, and rare events that are beyond the realm of normal expectations in history, science, finance and technology. In other words, according to Taleb, almost all major scientific discoveries, historical, financial, and technological events, and artistic accomplishments are undirected and unpredicted. If this is so, it seems to me that a derivative hypothesis would be that government regulations will tend to react to rather than counteract or prevent such crises. See: The Black Swan, Taleb, Nassim Nicholas, 2007, Random House

[7] Some legal experts say Section 929I of the Act could be interpreted to mean that the SEC can set its own rules about how to respond to Freedom of Information Act requests and that, potentially, the majority of SEC records could be exempt from public disclosure. The wording of the section says that the SEC should not be compelled to disclose records or information obtained “for use in furtherance of the purposes of this title, including surveillance, risk assessments, or other regulatory and oversight activities.” Representative Darrell Issa (R-CA), the ranking member of the House Committee on Oversight and Government Reform, introduced legislation (HR 5924) back in May to repeal Section 929I. However, two other provisions have been identified that, in the interest of helping corporations shield information from the public, allow the SEC to ignore certain court subpoenas and FOIA requests.

[8] Section 1503(3)(A)(i) of the SAFE Act defines "loan originator" as "an individual who (I) takes a residential mortgage loan application; and (II) offers or negotiates terms of a residential mortgage loan for compensation or gain." Section 1503(3)(B), entitled "Other Definitions Relating to Loan Originator" provides "For purposes of this subsection, an individual ‘assists a consumer in obtaining or applying to obtain a residential mortgage loan’ by, among other things, advising on loan terms (including rates, fees, other costs), preparing loan packages, or collecting information on behalf of the consumer with regard to a residential mortgage loan.

[9] Among amendments to the SAFE Act, the requirement to establish and maintain a system for registering employees of depository institutions and their subsidiaries regulated by a federal banking agency as registered loan originators with the Nationwide Mortgage Licensing System and Registry is being transferred to the Bureau.

[10] The Act expressly permits compensation to a creditor upon the sale of a consummated loan to a subsequent purchaser (i.e., secondary market transaction). And a consumer may finance origination fees or costs, as long as the fees or costs do not vary based on loan terms or the consumer’s decision to finance such fees, providing this financing takes place at the consumer’s option and solely through principal or rate. Also allowed are “incentive payments” to the MLO based on the number of loans originated within a specified period of time. See Second Summary of Mortgage Related Provisions of the Dodd-Frank Wall Street Reform and Consumer Protection Act (H.R. 4173), 7/13/10, Mortgage Bankers Association

[11] For a general description of predatory lending, see “Expanded Guidance for Evaluating Subprime Lending Programs,” FIL-9-2001 (1/31/01) which states that predatory lending involves at least one, and perhaps all three, of the following elements: (1) making unaffordable loans based on the assets of the borrower rather than on the borrower's ability to repay an obligation; (2) inducing a borrower to refinance a loan repeatedly in order to charge high points and fees each time the loan is refinanced ("loan flipping"); or (3) Engaging in fraud or deception to conceal the true nature of the loan obligation, or ancillary products, from an unsuspecting or unsophisticated borrower." Other federal and many state guidelines add even broader definitions to the meaning of predatory lending.

[12] See TILA, Section 129C(b)(2) for the definition of “qualified mortgage,” which includes most residential mortgage loan products, and also includes reverse mortgages (see: TILA Sec. 129C(b)(2)(A), as added by Sec. 1412 of the Dodd-Frank Act), although there is an exemption for reverse mortgages or bridge loans with a 12 month or less repayment period.

[13] Used to pay taxes and hazard insurance and, if applicable, certain other costs with respect to the secured property; must remain in place for at least five (5) years after loan consummation.

[14] Section 6 of RESPA requires the lender (or servicer) to acknowledge receipt of the QWR within 20 business days and must try to resolve the issue within 60 business days.

[15] See: TILA Sec. 129H, as added by Sec. 1471 of the Dodd-Frank Act. "Higher-risk mortgage" means a residential mortgage loan (other than a reverse mortgage that is a qualified mortgage) secured by a principal dwelling that (a) is not a qualified mortgage and (b) has an annual percentage rate (APR) that exceeds the average prime offer rate for a comparable transaction as of the date the interest rate is set. For thresholds, see also TILA Sec. 129H(f), as added by Sec. 1471 of the Dodd-Frank Act.

[16] In 2009 the Chinese drywall controversy reached Congress as a health and safety issue involving defective drywalls manufactured in China and imported by the United States starting in 2001. It is also considered an issue in many foreclosures. And in May 2009, the House passed an amendment to the Mortgage Reform and Predatory Lending Act (HR 1728) that would require HUD to study the effects of tainted Chinese drywalls on foreclosures and the availability of property insurance.

[17] Op.cit. 4, provides the “enumerated laws,” to which add Section 626 of the Omnibus Appropriations Act and the Interstate Land Sales Full Disclosure Act.