Overview

On June 23, 2010, the Office of the Controller of the Currency (OCC) and the Office of Thrift Supervision (OTS) jointly issued their Mortgage Metric Report (Report) for the first quarter 2010. The Report provides performance data on first-lien residential mortgages serviced by national banks and federally regulated thrifts. These mortgages comprise more than 64% of all mortgages outstanding in the United States.

Among the disclosed statistics, the Report showed that approximately 41% of loan modifications made in second quarter of 2009 were 60 days or more delinquent nine (9) months after the modification, and the failure rate within nine (9) months was almost 52% in the fourth quarter of 2008.

The Report further discloses that nearly 25% of loan modifications made in the fourth quarter of 2009 were 30 days or more delinquent after three (3) months and Home Affordable Modification Program (HAMP) recidivism rate was 17% in the same period.

Although the Report's Key Findings, Mortgage Performance, Home Retention Actions: Loan Modifications, Trial Period Plans, and Payment Plans, Modified Loan Performance, and Foreclosures and Other Home Forfeiture Actions give varying results, both positive and negative -- as the saying goes, the "devil is in the details!"

Highlights

Findings

- Delinquency rates dropped in the first quarter of 2010, with improvement in all categories of mortgages-prime, Alt-A, and subprime.

- The number of foreclosures increased substantially, including new foreclosures, foreclosures in process, and completed foreclosures.

- The number of loan modifications and other home retention actions also increased.

- Re-default rates for modified mortgages remain high.

- Recent "vintages" (i.e., 2009 loan modifications) performed better.

Charts

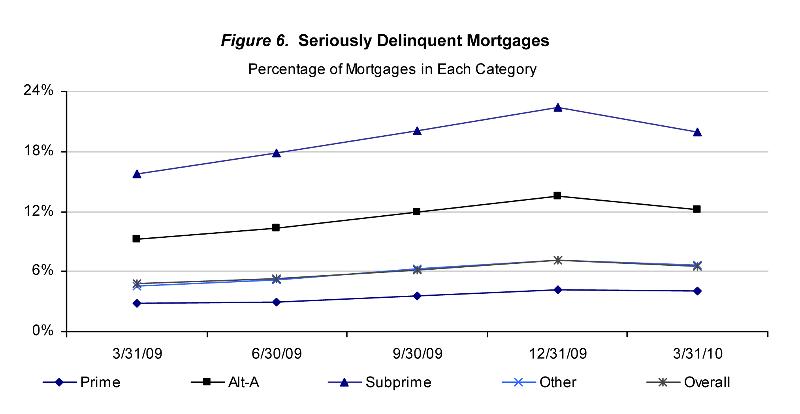

Serious delinquencies declined across all risk categories during the first quarter of 2010. Subprime mortgages recorded the most significant improvement, while prime loans had the least improvement. Overall, there were 2,210,495 seriously delinquent mortgages at the end of the first quarter, 7.5 percent less than the prior quarter but 36 percent more than a year ago.

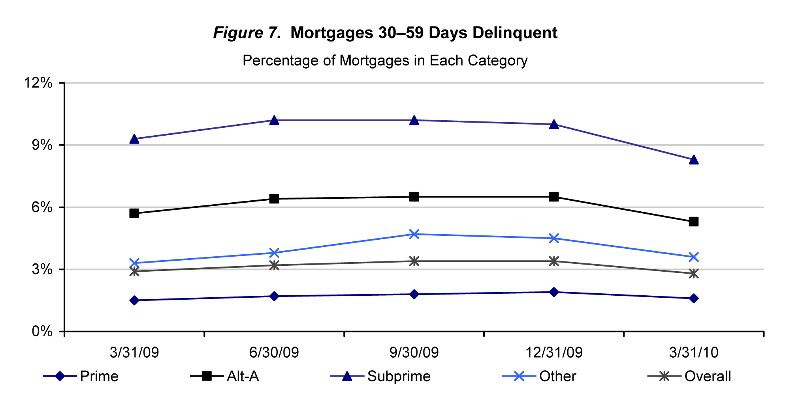

Early stage delinquencies-mortgages 30-59 days delinquent-significantly declined across all risk categories during the first quarter. Overall, early-stage delinquencies, at 2.8 percent, were 17.7 percent less than the prior quarter and 3.6 percent less than a year ago.

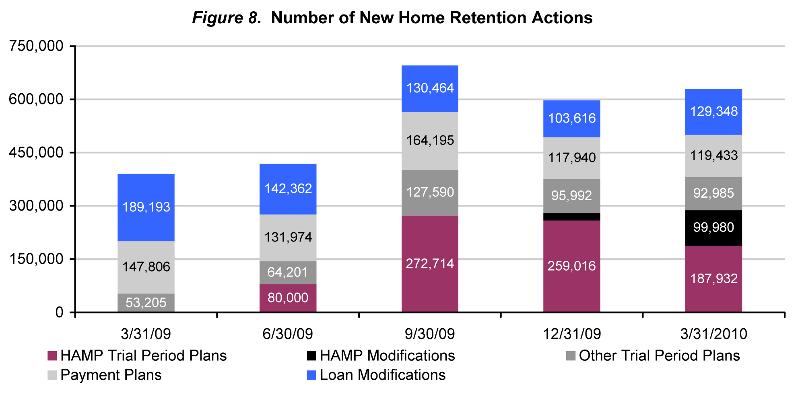

During the first quarter of 2010, servicers implemented 629,678 new home retention actions: loan modifications, trial period plans, and payment plans. This 5.4 percent increase in home retention actions from the prior quarter was driven by the 79,301 increase in HAMP modifications and 25,732 increase in other modifications, which more than offset the 74,091 decrease in new trial period plans. In total, servicers initiated 2,731,408 home retention actions over the last five quarters.

Visit Library for Issuance

Mortgage Metrics Report

Disclosure of National Bank and Federal Thrift Mortgage Loan Data

First Quarter 2010

Issued 06/23/10